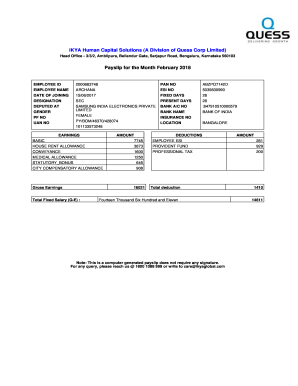

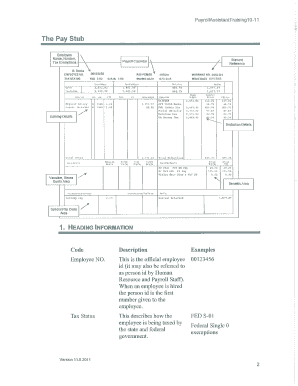

Get the free here are the steps you the payslip to the employees

Show details

CEA 4. BASIC CONDITIONS OF. EMPLOYMENT ACT, 1997 PAYSLIP. Section 33. READ THIS FIRST. NAME OF EMPLOYER:.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payslip template form

Edit your payslip template south africa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payslip template download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing editable payslip template south africa online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pdffiller form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out editable payslip template form

How to fill out payslip template South Africa?

01

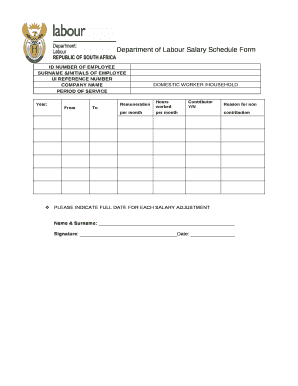

Start by entering basic employee information such as name, employee number, and job title. This information should be located at the top of the payslip template.

02

Next, input the pay period for which the payslip is being prepared. This includes the start and end dates of the pay period.

03

Calculate and enter the employee's gross earnings for the pay period. This includes the regular salary or wage, any overtime pay, bonuses, commissions, or any other additional income.

04

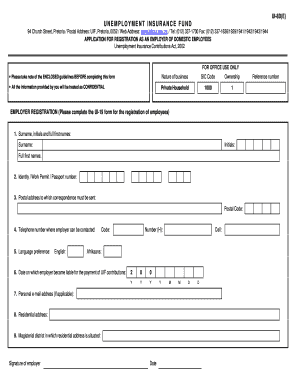

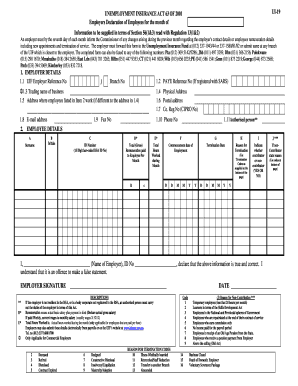

Deduct any statutory deductions from the employee's gross earnings. These may include income tax, UIF (Unemployment Insurance Fund) contributions, or any other mandatory contributions.

05

Subtract any voluntary deductions, such as retirement fund contributions, medical aid premiums, or loan repayments.

06

Calculate and enter the net pay, which is the final amount the employee will receive after all deductions. This should be clearly stated on the payslip.

07

Include a breakdown of all deductions and contributions made, including the amounts deducted for each category.

08

Provide a summary of the employee's leave balance, if applicable. This includes the number of days taken and the remaining balance.

09

Include any additional information or notes that may be relevant to the employee, such as upcoming public holidays or leave accrual policies.

Who needs payslip template South Africa?

01

Small business owners or entrepreneurs who employ staff and need to provide them with accurate and professional payslips.

02

Human resources professionals who are responsible for managing and documenting employee compensation and benefits.

03

Employees themselves, as they may use the payslip as proof of income for various purposes, such as applying for a loan or renting a property.

Note: A payslip template is essential for maintaining accurate records and ensuring compliance with labor laws and regulations in South Africa.

Fill

payslip download pdf

: Try Risk Free

People Also Ask about payslip template pdf download

What is basic simple salary slip?

Here is an example of an salary pay slip format. Company Name and Logo. Employee Information. Name: Employee ID: Department: Earnings. Basic Salary: Allowances: Deductions. Taxes: Social Security Contributions: Net Pay:

Can you create your own payslip?

However, there are some easy ways for you to make your own payslips. The easiest way is to use something like Microsoft Excel. The spreadsheets allow you to create a custom payslip. And once you figure out how you're going to create them, it becomes as easy as inputting a few details each pay period.

Is a payslip a legal document in South Africa?

An employer is obliged to provide an employee with a proper payslip on each payday. Deductions from remuneration.

How do I make a payslip in South Africa?

What should be included in a South African Employee Payslip Employee Details: This should include the employee's name, employee number, and pay period. Gross Pay: This is the total amount earned by the employee before deductions. Deductions: This should include all deductions made from the employee's gross pay.

How do I make a simple payslip?

Here are the steps you should take: Create a new row in the YTD worksheet. Enter all the information for a pay date, pay period, hours, and payment amounts. Select the pay date from the drop-down at the top of the free payslip template. Double-check, print and send the payslip to the employees.

How to get payslip online in South Africa?

Login to ESS and move to 'Payroll' screen through the RHS menu. Users can find the list of payslips sorted Salary Period wise. Click on any salary period to view the payslip of that particular period. The video below explains how ESS users can access their payslips online.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my south african payslip template directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your payslip generator south africa and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit pay slip template in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing payslip south africa and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my payslip templates in Gmail?

Create your eSignature using pdfFiller and then eSign your how to get payslip online can access their payslips online immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is payslip template?

A payslip template is a standardized document that outlines an employee's earnings, deductions, and net pay for a specific pay period.

Who is required to file payslip template?

Employers are required to provide payslips to their employees, detailing their earnings and deductions for each pay period.

How to fill out payslip template?

To fill out a payslip template, input the employee's name, pay period, gross earnings, itemize deductions (such as taxes and benefits), and calculate the net pay.

What is the purpose of payslip template?

The purpose of a payslip template is to provide transparency to employees regarding their compensation, ensuring they understand their earnings and deductions.

What information must be reported on payslip template?

A payslip template must report the employee's name, pay period, gross pay, deductions (such as taxes and insurance), and net pay due.

Fill out your here are form steps online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Note A Payslip Template Is Employee Number And Pay Period is not the form you're looking for?Search for another form here.

Keywords relevant to fill payslip south africa pdf form try risk text monthly payslip template template for payslip south africa editable payslip download payslips pdf undefined

Related to payslip pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.